Zerodha is one of the most popular stockbrokers in India, known for its transparent pricing and low brokerage fees. However, understanding brokerage charges can sometimes be confusing for beginners. That’s where the Zerodha Brokerage Calculator comes in handy. This tool allows traders to calculate the exact costs associated with their trades, helping them make informed decisions. In this guide, we will explore how to use the Zerodha Brokerage Calculator effectively and understand the various charges associated with trading.

1. What is the Zerodha Brokerage Calculator?

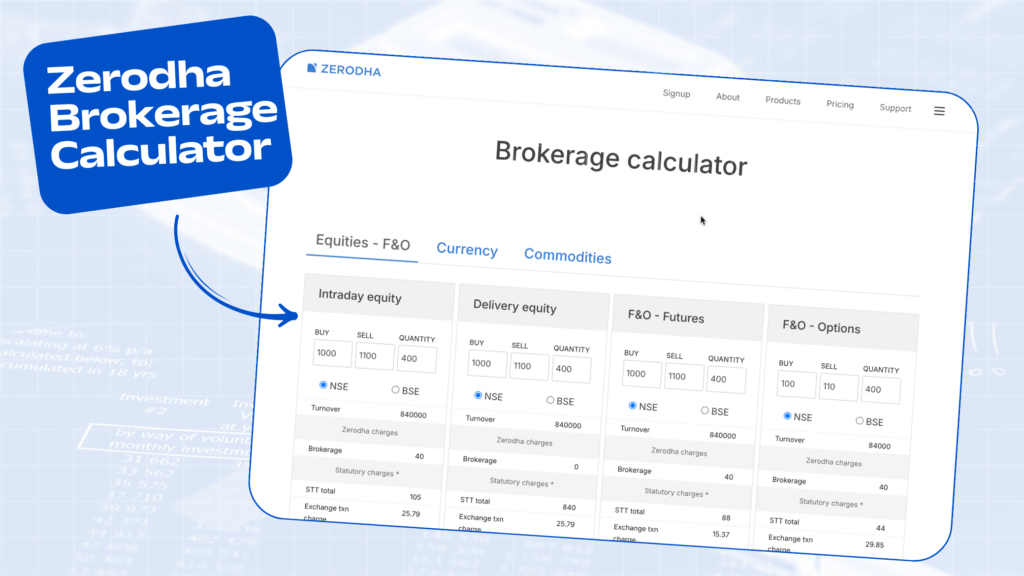

The Zerodha Brokerage Calculator is an online tool that helps traders determine the total cost of executing a trade. Including brokerage fees, transaction charges, GST, SEBI charges, and stamp duty. It provides an accurate estimate of the net profit or loss before placing a trade. This tool is beneficial for both beginners and experienced traders who want to have complete clarity on their trading expenses.

By using the calculator, traders can ensure that they do not encounter any hidden charges that could affect their profits. It is a crucial tool for risk management, helping investors make smarter trading decisions while being aware of all costs involved.

2. How to Access the Zerodha Brokerage Calculator?

Accessing the brokerage calculator is simple and can be done in a few easy steps:

- Visit the Zerodha official website.

- Navigate to the ‘Brokerage Calculator section under the ‘Pricing’ tab.

- Choose the segment you wish to calculate charges for, such as equity delivery, intraday, F&O, currency, or commodities.

- Enter the required trade details and instantly get a cost breakdown.

The accessibility of the calculator ensures that traders can check their costs anytime before placing a trade, reducing the chances of miscalculations.

3. Understanding the Input Fields

When using the brokerage calculator, you need to enter certain details:

- Buy Price: The price at which you plan to buy the stock.

- Sell Price: The price at which you intend to sell the stock.

- Quantity: The number of shares you wish to trade.

- Segment: Select whether you are trading in equity, futures, options, commodities, or currencies.

These inputs are crucial because the charges vary depending on the type of trade, market segment, and stock exchange. Ensuring that you enter accurate details will provide the most precise brokerage calculation.

4. Breakdown of Charges in the Calculator

Once you enter the required details, the Zerodha Brokerage Calculator provides a detailed breakdown of charges. Understanding these charges will help you interpret the overall trading cost better:

a) Brokerage Fee

- For equity delivery, Zerodha charges zero brokerage, making it an attractive option for long-term investors.

- For intraday and F&O trading, the brokerage is either Rs. 20 or 0.03% per executed order, whichever is lower.

b) Exchange Transaction Charges

- These charges vary depending on the exchange (NSE/BSE) and the type of trade (equity, derivatives, commodities, etc.).

- It is essential to account for these costs, as they add up when multiple trades are executed.

c) Securities Transaction Tax (STT)

- STT is levied on the buy/sell side depending on the segment. It is applicable only for equity transactions and futures.

- It is a government-imposed tax, and traders should be aware of its effect on overall profitability.

d) GST (Goods and Services Tax)

- GST is charged at 18% on brokerage and transaction charges.

- This tax component should be factored in while estimating trade costs.

e) SEBI Charges

- A nominal charge levied by SEBI on all trades to regulate market operations.

f) Stamp Duty

- This varies based on the state in which the trade is executed and the segment of the trade.

- It is an essential cost component that traders should not overlook.

5. How to Interpret the Results?

After entering the trade details, the calculator displays:

- Total Brokerage Charges: The sum of all costs, including taxes.

- Net Profit or Loss: The actual amount you will earn or lose after deducting charges.

- Break-even Price: The minimum price at which you need to sell to cover all costs.

Interpreting these results correctly will help traders set realistic profit expectations and avoid unnecessary losses due to miscalculated expenses.

6. Benefits of Using the Zerodha Brokerage Calculator

- Transparency: Traders can see the exact amount they are paying in fees.

- Helps in Trade Planning: Knowing the break-even price helps in setting realistic target prices.

- Reduces Surprises: Many beginners overlook hidden charges, but this tool provides complete clarity.

- Aids in Strategy Development: Knowing all costs upfront helps traders create better risk management and investment strategies.

7. Example Calculations

Let’s consider an example of an intraday trade:

- Buy Price: Rs. 500

- Sell Price: Rs. 510

- Quantity: 100 shares

Upon entering these values in the calculator, it will show the total charges, including brokerage, STT, GST, and other fees, along with the net profit or loss from the trade.

Similarly, traders can use the calculator for F&O trading, commodities, and currency trades to get an idea of their overall trading costs.

8. Tips for Minimizing Brokerage Costs

- Prefer equity delivery trades as they have zero brokerage charges.

- Keep track of all charges before placing a trade to avoid losses due to hidden costs.

- Use GTT (Good Till Triggered) orders to plan trades effectively.

- Execute fewer but larger trades instead of multiple smaller trades to reduce brokerage costs.

- Monitor tax implications and transaction fees to ensure maximum profitability.