Investing in financial markets can be overwhelming, especially for beginners. With numerous platforms offering investment options, choosing the right one is crucial. Groww, an Indian fintech company, has become a favourite among new investors. With its user-friendly interface, diverse investment options, and transparent processes. Groww provides an excellent platform for those stepping into the world of investments.

Seamless Account Opening Process

One of the biggest challenges for new investors is setting up an investment account. Groww simplifies this process with a fully digital and paperless approach. Here’s why its account opening is so seamless:

- 100% Online Process: Investors can open an account from the comfort of their homes without the need for physical paperwork.

- Quick KYC Verification: The Know Your Customer (KYC) process is simple, requiring a PAN card, Aadhaar card, and bank details.

- Zero Account Opening Fees: Unlike many traditional brokerage firms, Groww does not charge any fees for opening an account.

- Instant Activation: Once the documents are verified, the account is activated swiftly, allowing users to start investing immediately.

User-Friendly Interface

A complex interface can be a deterrent for beginners. Groww design focuses on simplicity and ease of use, making it an ideal platform for new investors.

- Intuitive Dashboard: The platform provides a clean, clutter-free dashboard with easy navigation.

- One-Click Investments: Whether it’s stocks, mutual funds, or other instruments, investing is as simple as a single click.

- Mobile and Web Accessibility: Groww is available both as a mobile app and a web platform, ensuring flexibility for investors on the go.

Wide Range of Investment Options

Groww offers multiple investment options, allowing new investors to diversify their portfolios with ease.

- Stocks: Invest in direct equities of Indian companies with real-time data and analysis tools.

- Mutual Funds: Choose from thousands of mutual funds with options for SIP (Systematic Investment Plan) and lump sum investments.

- Gold Investments: Digital gold investment options are available for those looking for safer assets.

- Fixed Deposits: Investors can park their money in fixed deposits for stable returns.

- US Stocks: Groww provides access to global markets, allowing investors to buy shares of popular companies like Apple, Tesla, and Amazon.

Low Brokerage and No Hidden Charges

One of Groww’s major advantages is its transparent pricing structure.

- No Commission on Mutual Funds: Unlike traditional brokers, Groww offers direct mutual funds with zero commission, leading to higher returns.

- Competitive Brokerage Fees: Groww charges only Rs. 20 or 0.05% (whichever is lower) per executed order for stocks.

- No Annual Maintenance Charges (AMC): Many platforms charge AMCs for Demat accounts, but Groww offers it for free.

- Free Fund Transfers: Users can transfer funds without additional charges, making transactions cost-effective.

Educational Resources for Beginners

For new investors, learning the basics of investing is as important as investing itself. Groww provides various learning tools:

- Blogs and Articles: Regularly updated with investment tips, market trends, and financial news.

- Video Tutorials: The platform’s YouTube channel offers investment guides, market insights, and financial literacy content.

- Webinars and Live Sessions: Expert-led sessions help investors understand different asset classes and investment strategies.

- Investment Calculators: SIP calculators, FD calculators, and other tools assist investors in making informed decisions.

Advanced Security Features

Security is a major concern when dealing with financial transactions. Groww ensures data protection through:

- 128-bit SSL Encryption: Protects user data from cyber threats.

- 2-Factor Authentication (2FA): Adds an extra layer of security for account login and transactions.

- Secure Payment Gateways: Bank transfers and UPI transactions are conducted through encrypted channels.

- SEBI and AMFI Registered: Groww is a registered broker with the Securities and Exchange Board of India (SEBI) and the Association of Mutual Funds in India (AMFI), ensuring regulatory compliance.

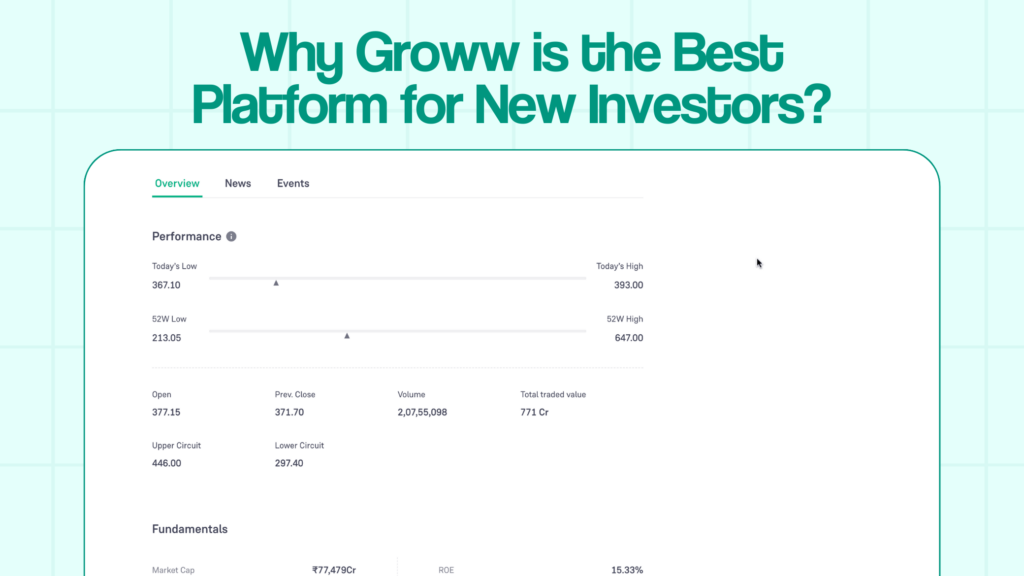

Real-Time Market Insights and Analysis

New investors often struggle with market analysis. Groww offers useful tools and insights to assist investors:

- Stock Market Data: Real-time price tracking, historical charts, and performance analytics.

- Mutual Fund Ratings: Expert ratings and historical data on mutual funds to help users make informed decisions.

- Market News and Updates: Keep investors updated on financial developments, stock market trends, and economic events.

- Comparison Tools: Compare stocks and mutual funds based on various performance metrics.

Efficient Customer Support

Having reliable customer support is essential for new investors. Groww provides excellent customer service through:

- Live Chat Support: Quick responses to queries via chat.

- Email Support: Prompt resolution of investor concerns.

- Help Center: A well-organized FAQ section addressing common investment-related questions.

- Community Forum: A space for investors to discuss queries and investment strategies.

Final Thought

Groww has revolutionized the way new investors access financial markets. Its easy account setup, user-friendly interface. Zero-commission mutual funds, and extensive educational resources make it the best choice for beginners. With robust security measures and reliable customer support, Groww ensures a seamless investment experience.

Whether you are just starting your investment journey or looking for a hassle-free platform. Groww provides everything you need to build a strong financial future. With continuous innovation and investor-friendly features, it remains one of India’s top investment platforms for beginners.