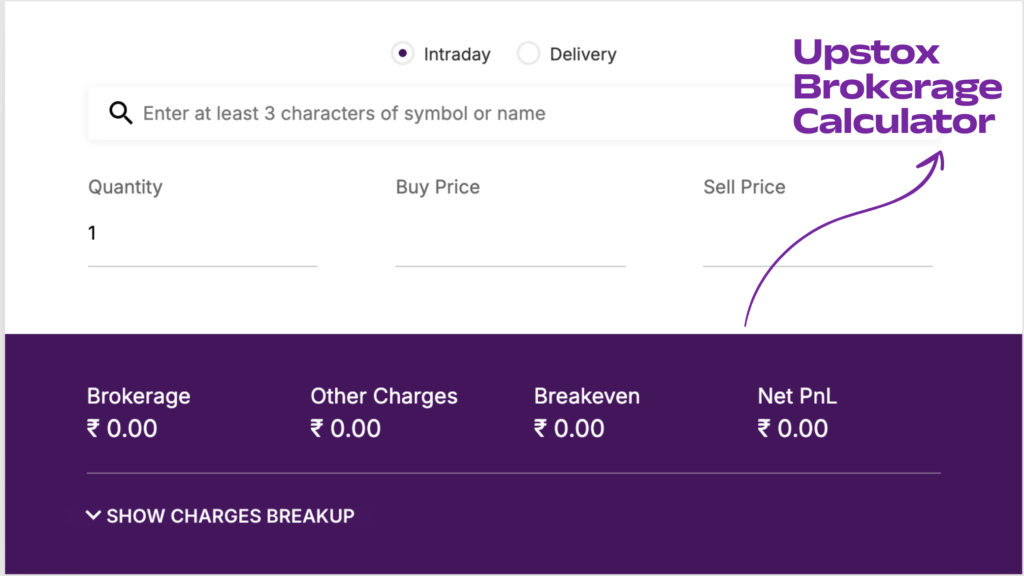

Planning your trades effectively is crucial for optimizing your profits and managing risks. One of the best tools available for traders using Upstox is the Upstox Brokerage Calculator. This calculator helps traders estimate their trading costs, including brokerage fees, transaction charges, and taxes. Allowing them to make informed decisions before executing trades. In this guide, we will explain how to use the Upstox Brokerage Calculator and how it can help you plan your trades efficiently.

What is the Upstox Brokerage Calculator?

The Upstox Brokerage Calculator is an online tool that allows traders to calculate the total cost of their trades, including brokerage charges. Securities Transaction Tax (STT), GST, stamp duty, exchange transaction charges, and SEBI turnover fees. It provides an accurate breakdown of costs, helping traders understand their potential net profit or loss before executing a trade.

Why Should You Use the Brokerage Calculator?

Using the Upstox Brokerage Calculator offers several benefits, including:

- Transparency: It provides a clear breakdown of all costs associated with a trade.

- Cost Management: Helps traders optimize their trade sizes to minimize expenses.

- Better Trade Planning: Allows traders to set realistic profit targets based on actual costs.

- Avoid Hidden Charges: Ensures that traders are fully aware of the charges they will incur.

How to Access the Upstox Brokerage Calculator

Accessing the calculator is simple:

- Visit the Upstox official website.

- Navigate to the ‘Brokerage Calculator’ section.

- Choose the trading segment (Equity Delivery, Intraday, Futures, Options, Commodities, or Currencies).

- Enter the required trade details to get an instant cost breakdown.

How to Use the Upstox Brokerage Calculator?

To calculate your brokerage and total trading costs using the Upstox Brokerage Calculator, follow these steps:

Step 1: Select Your Trading Segment

Upstox offers various trading segments, including:

- Equity Delivery (No brokerage fees on delivery trades)

- Equity Intraday

- Equity Futures and Options

- Currency and Commodity Trading

Choose the appropriate segment based on your trade.

Step 2: Enter Trade Details

You need to provide the following details:

- Buy Price: The price at which you plan to buy the security.

- Sell Price: The price at which you intend to sell the security.

- Quantity: The number of shares or contracts you wish to trade.

Step 3: Review the Cost Breakdown

Once you enter your trade details, the calculator will display:

- Brokerage Fee (Based on Upstox’s pricing structure)

- STT (Securities Transaction Tax)

- Exchange Transaction Charges

- SEBI Turnover Charges

- Stamp Duty

- GST on Brokerage and Transaction Fees

- Total Charges

- Net Profit or Loss After Charges

Understanding the Cost Components

It is important to understand the different components of your trading costs:

a) Brokerage Charges

- Equity Delivery: Zero brokerage.

- Equity Intraday, F&O, Currency, and Commodities: Rs. 20 per executed order or 0.05% (whichever is lower).

b) Securities Transaction Tax (STT)

STT is a government-imposed tax levied on securities transactions. It varies based on the trading segment.

c) Exchange Transaction Charges

These are charges imposed by stock exchanges like NSE and BSE for facilitating trades.

d) SEBI Turnover Charges

A small fee was levied by SEBI to regulate the securities market.

e) Stamp Duty

Stamp duty varies by state and is imposed on the total traded value.

f) GST (Goods and Services Tax)

GST is charged at 18% on brokerage and transaction fees.

Example Calculations Using the Upstox Brokerage Calculator

Example 1: Intraday Trade

Let’s say you plan to buy 100 shares of a stock at Rs. 500 and sell them at Rs. 510.

- Buy Price: Rs. 500

- Sell Price: Rs. 510

- Quantity: 100 shares

After entering these values in the calculator, it will display:

- Total brokerage fee

- Exchange and regulatory charges

- Net profit after all costs

Example 2: Options Trade

Suppose you buy 10 lots of NIFTY 50 call options at a premium of Rs. 100 per lot.

- Buy Premium: Rs. 100 per lot

- Sell Premium: Rs. 110 per lot

- Quantity: 10 lots

The calculator will provide a detailed cost breakdown, including brokerage, GST, and exchange charges.

Tips to Reduce Trading Costs

Reducing trading costs can improve profitability. Here’s how:

- Use Equity Delivery for Long-Term Investments (Zero brokerage charges).

- Optimize Trade Size to reduce brokerage fees.

- Use Limit Orders Instead of Market Orders to avoid slippage.

- Avoid Excessive Intraday Trades to minimize transaction costs.

- Leverage Margin Smartly to balance risk and cost.

Who Should Use the Upstox Brokerage Calculator?

- Beginner Traders: Helps understand trading costs before executing trades.

- Intraday Traders: Essential for calculating profit margins accurately.

- F&O Traders: Useful for estimating option and futures trading costs.

- Long-Term Investors: Helps in making cost-effective investment decisions.

Common Mistakes Traders Make While Estimating Costs

Ignoring Hidden Charges

Many traders overlook charges like GST, SEBI fees, and stamp duty, which can impact profitability.

Not Factoring in Slippage

Execution price differences due to market volatility can affect trade profitability.

Overtrading Without Cost Awareness

Frequent trading can lead to excessive fees, reducing net profits.

Conclusion

The Upstox Brokerage Calculator is an invaluable tool for traders looking to optimize their trading strategy. Providing a transparent cost breakdown enables traders to plan trades more effectively, minimize expenses, and maximize profits. Whether you are an intraday trader, options trader, or long-term investor, using the brokerage calculator can help you make well-informed financial decisions.