Investing in Initial Public Offerings (IPOs) has always been an exciting opportunity for investors to acquire shares of a company at its launch price before they start trading on the stock market. Upstox, one of India’s leading discount brokers, offers a seamless way to invest in IPOs, ensuring an easy and hassle-free application process. If you’re looking to invest in upcoming IPOs, Upstox provides the right tools, information, and platform to help you make informed decisions.

Why Invest in IPOs?

IPOs provide investors with the opportunity to buy shares at an early stage, which can lead to substantial returns if the company performs well post-listing. Here are some key benefits of investing in IPOs:

- Early Entry Advantage: Investing in a company’s stock before it gets listed can yield significant returns if the stock price appreciates after listing.

- Diversification: IPOs allow investors to diversify their portfolios by adding new and emerging companies.

- Potential Listing Gains: Many IPOs witness a surge in stock prices on their debut trading day, offering short-term gains to investors.

- Long-Term Growth Prospects: If chosen wisely, IPOs can lead to long-term wealth creation as the company grows.

How to Apply for an IPO on Upstox?

Upstox simplifies the IPO investment process, making it accessible to both new and experienced investors. Here’s a step-by-step guide to applying for an IPO through Upstox:

a. Open a Demat and Trading Account

Before investing in an IPO, you need a Demat and trading account. Upstox provides a quick and paperless account opening process that can be completed within minutes.

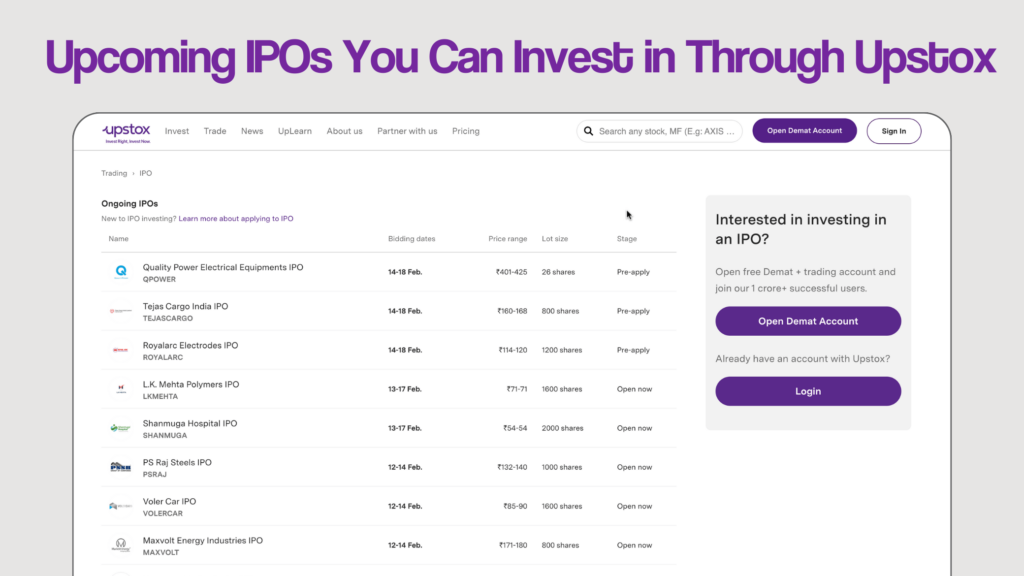

b. Check the List of Upcoming IPOs

Upstox has a dedicated section displaying upcoming IPOs along with key details such as:

- Company Name

- Issue Size

- Price Band

- Lot Size

- Opening and Closing Dates

c. Apply for the IPO

Once you have selected an IPO, follow these simple steps to apply:

- Log in to the Upstox app or website.

- Go to the ‘IPO’ section.

- Select the IPO you wish to apply for.

- Enter the quantity and bid price.

- Use UPI as the payment method and confirm the application.

- Approve the UPI mandate request in your payment app.

d. Track the IPO Allotment Status

After applying, you can check the allotment status on Upstox. If allotted, shares will be credited to your Demat account before the listing date.

Upcoming IPOs to Watch Out For

Here are some of the most anticipated IPOs in 2024:

XYZ Tech Ltd.

- Industry: IT & Software

- Issue Size: Rs.1,500 Cr

- Price Band: Rs.450-Rs.500

- Listing Date: March 2024

ABC Pharma Ltd.

- Industry: Pharmaceuticals

- Issue Size: Rs.800 Cr

- Price Band: Rs.300-Rs.350

- Listing Date: April 2024

LMN Retail Pvt. Ltd.

- Industry: E-commerce

- Issue Size: Rs.1,200 Cr

- Price Band: Rs.600-Rs.650

- Listing Date: May 2024

(For the latest updates, always refer to the Upstox platform.)

Factors to Consider Before Investing in an IPO

Before applying for an IPO, investors should consider:

- Company Fundamentals: Review financial statements, growth potential, and business model.

- Industry Outlook: Evaluate the industry trends and the company’s position within it.

- Issue Pricing: Compare the price band with industry peers.

- Institutional Interest: A high number of anchor investors or institutional subscriptions often indicate strong demand.

- Lock-in Periods: Be aware of any restrictions on selling shares post-listing.

Why Choose Upstox for IPO Investments?

Upstox provides multiple advantages for IPO investors:

- Paperless & Seamless IPO Applications

- UPI-Based Fast Payment & Refunds

- Real-Time IPO Tracking & Alerts

- Comprehensive Research Reports & Analysis

- User-Friendly Mobile & Web Platforms

Final Thought

Investing in upcoming IPOs through Upstox is a smart and efficient way to participate in the stock market. With its intuitive platform, real-time updates, and seamless application process, Upstox makes IPO investments accessible to everyone. Whether you are a seasoned investor or a beginner, Upstox provides the right tools to help you make informed investment decisions.