Investing and trading in the stock market can be a rewarding experience, but it often comes with hidden costs that traders and investors need to be aware of. One of the most important expenses in stock trading is brokerage fees, which can significantly impact overall returns. To optimize trading costs and maximize profits, Angel One, a leading brokerage firm in India, provides an easy-to-use Brokerage Calculator. This tool helps traders understand and estimate their brokerage charges in advance, enabling them to make informed trading decisions. In this article, we will explore how Angel One’s Brokerage Calculator works, its key benefits, and how it can help traders save on trading costs.

Understanding Brokerage Fees in Stock Trading

Brokerage fees are charges levied by a broker for executing buy and sell orders on behalf of a trader. These fees vary based on multiple factors such as trade type, segment (equity, derivatives, commodities, etc.), and trade volume.

Types of Brokerage Charges:

- Equity Delivery Brokerage: Charges applicable for buying stocks and holding them beyond a single trading session.

- Equity Intraday Brokerage: Fees for buying and selling stocks on the same day.

- Futures and Options (F&O) Brokerage: Costs associated with trading in derivative segments like stock and index futures and options.

- Commodity & Currency Brokerage: Fees for trading in commodities (MCX) and currency derivatives.

- Call & Trade Charges: Extra fees for placing orders via phone.

The total trading cost also includes additional charges such as SEBI turnover fees, exchange transaction charges, Goods and Services Tax (GST), stamp duty, and Securities Transaction Tax (STT). Without a clear understanding of these costs, traders may find their profits diminished by unexpected deductions.

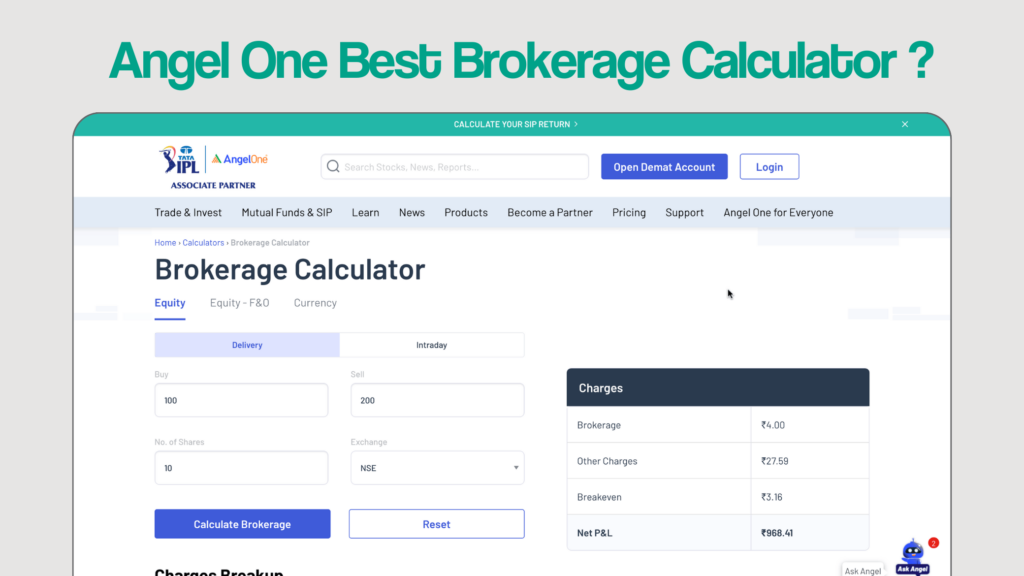

What is the Angel One Brokerage Calculator?

The Angel One Brokerage Calculator is a free online tool that helps traders calculate the total brokerage and other applicable charges before placing a trade. This calculator allows users to estimate net profits or losses for a particular trade, ensuring better financial planning.

How to Use the Angel One Brokerage Calculator?

- Visit the Angel One website or open the Angel One app.

- Select the trading segment (Equity, F&O, Commodities, or Currency).

- Enter trade details like buy price, sell price, quantity, and segment type.

- Click on ‘Calculate’ to view the estimated brokerage charges and net profit/loss.

- Analyze the cost breakdown to optimize trades for better profitability.

Benefits of Using the Angel One Brokerage Calculator

Using a brokerage calculator offers several advantages that help traders make informed decisions and save costs.

a. Transparent Cost Estimation

The calculator provides a detailed breakdown of all applicable fees, including brokerage, taxes, and exchange charges. This transparency allows traders to accurately estimate their net earnings and avoid surprises.

b. Helps in Trade Planning

Traders can compare different trade scenarios and adjust their strategies accordingly. For example, they can assess whether executing a trade-in equity intraday rather than equity delivery is more cost-effective.

c. Reduces Brokerage Costs

By analyzing different trading strategies using the calculator, traders can choose lower-cost trading options and avoid unnecessary fees. For instance, intraday trading at Angel One offers lower brokerage charges compared to delivery trades.

d. Enhances Profitability

Knowing the exact cost associated with a trade helps traders determine their breakeven points and set profit targets more effectively. This ensures that their trade decisions are driven by profitability rather than hidden charges.

e. Saves Time and Effort

Manually calculating brokerage fees and other charges can be time-consuming and prone to errors. The brokerage calculator automates this process, providing instant and accurate results.

How Angel One Low Brokerage Model Helps Traders Save

Angel One offers one of the most competitive brokerage fee structures in India, helping traders save on trading costs. Here’s how:

a. Zero Brokerage on Equity Delivery

Angel One charges zero brokerage on equity delivery trades, making it a great option for long-term investors.

b. Flat Rs.20 per Order for F&O and Intraday Trading

Traders benefit from a flat Rs.20 per executed order for intraday, F&O, and commodity trading, regardless of trade volume. This is highly cost-effective for high-frequency traders.

c. Discount Brokerage Model

Angel One operates on a discount brokerage model, ensuring that trading costs remain low compared to traditional full-service brokers.

d. No Hidden Charges

All brokerage and other costs are transparently displayed in the calculator, ensuring traders are fully aware of their expenses before executing trades.

Maximizing Savings with the Angel One Brokerage Calculator

Here are some practical tips to reduce trading costs using the calculator:

a. Compare Different Trading Segments

Use the calculator to compare costs between intraday, delivery, and F&O trades. This helps in choosing the most cost-effective trading method.

b. Optimize Trade Volume

By tweaking trade quantity and frequency, traders can identify cost-effective trading volumes that minimize brokerage fees.

c. Avoid Overtrading

Excessive trading leads to high brokerage fees. The calculator helps in planning trades more efficiently, reducing unnecessary transactions.

d. Use Margin Smartly

Margin trading can amplify profits, but it also increases costs. Using the calculator to analyze margin trades helps in better risk management.

Final Thought

Trading costs play a crucial role in determining overall profitability, and using the Angel One Brokerage Calculator is a smart way to manage these expenses. The tool offers transparency, cost-saving insights, and helps traders make better financial decisions. With zero brokerage on equity delivery, flat Rs.20 per trade on intraday & F&O, and an easy-to-use calculator, Angel One ensures that traders can maximize their profits while keeping costs under control.