The Goods and Services Tax (GST) is a unified tax system in India that replaces multiple indirect taxes, streamlining compliance for businesses. Any business with an annual turnover above Rs. 40 lakh (Rs. 10 lakh for special category states) must register under GST. GST Registration is now an entirely online process, making it more convenient and accessible. This guide provides a step-by-step approach to registering for GST online, including eligibility, required documents, and the application process.

Who Needs to Register for GST?

GST registration is mandatory for:

- Businesses with a turnover exceeding Rs. 40 lakh (Rs. 10 lakh for special category states)

- Individuals or entities engaged in inter-state supply of goods or services

- E-commerce operators and aggregators

- Casual taxable persons and non-resident taxable persons

- Businesses involved in the supply of goods on behalf of others (agents and input service distributors)

Small businesses with an annual turnover of up to Rs. 1.5 crore can opt for the Composition Scheme, which allows them to pay GST at a lower rate with simplified compliance requirements. However, businesses under this scheme cannot claim an input tax credit.

Documents Required for GST Registration

Before proceeding with GST registration, ensure you have the following documents ready:

- PAN Card – Permanent Account Number of the business or individual

- Aadhaar Card – For identity verification

- Business Registration Certificate – Partnership deed, incorporation certificate, or proof of business registration

- Address Proof – Utility bill, rent agreement, or property tax receipt of business premises

- Bank Account Details – Canceled cheque, bank statement, or passbook

- Digital Signature (DSC) – Required for companies and LLPs

- Photographs – Passport-size photographs of the proprietor/partners/directors

- Authorization Letter – In the case of a company or partnership, an authorization letter for GST filing

How to Register for GST Online: Step-by-Step Process

Follow these steps to complete your GST registration online:

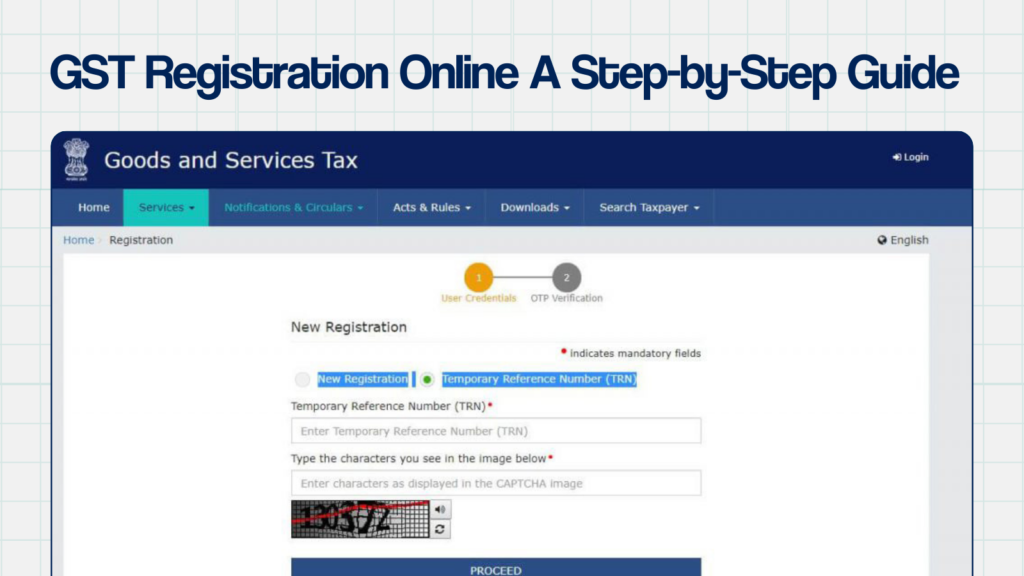

1: Visit the GST Portal

Go to the official GST portal: www.gst.gov.in.

2: Click on ‘Register Now’

- On the homepage, click on ‘Services’ > ‘Registration’ > ‘New Registration.’

- Select ‘Taxpayer’ as the type of applicant.

- Enter your details including PAN, mobile number, and email ID.

3: OTP Verification

- You will receive an OTP on your registered mobile number and email.

- Enter the OTP to verify your contact details.

4: Fill in Business Details

- Provide your business information including trade name, legal name, state, and district.

- Enter the business type (sole proprietorship, partnership, company, etc.).

- Provide the principal place of business address.

5: Upload Required Documents

- Upload scanned copies of the required documents mentioned earlier.

- Ensure that all documents are clear and in the correct format.

6: Receive ARN (Application Reference Number)

- After submitting the form, you will receive an ARN via email and SMS.

- You can track your application status using the ARN on the GST portal.

7: Verification and Issuance of GSTIN

- The GST officer will verify your application and documents.

- If no additional information is required, you will receive your GSTIN (Goods and Services Tax Identification Number) within 7 working days.

GST Registration Fees

There are no government fees for GST registration. However, businesses may need to pay professional service fees if they seek assistance from a tax consultant.

Post-Registration Compliance

Once you have received your GSTIN, you must comply with the following requirements:

- Display the GSTIN on invoices and business premises.

- File GST returns periodically (monthly, quarterly, or annually as applicable).

- Maintain records of all sales, purchases, and tax payments.

- Collect and remit GST from customers.

Common Mistakes to Avoid During GST Registration

- Incorrect Business Details – Ensure that trade name, PAN, and address match official records.

- Uploading Blurry Documents – Always provide clear and valid documents.

- Wrong HSN/SAC Code Selection – Selecting the incorrect classification may lead to compliance issues.

- Delays in Filing Returns – Failing to file GST returns on time can result in penalties.

Final Thought

GST registration is an essential step for businesses in India to comply with tax regulations and operate legally. The online registration process is designed to be seamless, but it requires accurate documentation and timely compliance. By following this step-by-step guide, businesses can easily register for GST and take advantage of a simplified tax system. If you face difficulties, consulting a GST expert can help ensure a smooth registration process.