Zerodha, India largest discount broker, has gained immense popularity due to its low-cost structure, user-friendly platforms, and seamless trading experience. If you are considering to open an account with Zerodha. It is essential to understand the charges involved and the step-by-step process to get started. In this guide, we will provide a comprehensive explanation of Zerodha account opening charges and the process to help you get started smoothly.

Why Open an Account with Zerodha?

Zerodha offers a range of investment opportunities, including equities, derivatives, mutual funds, commodities, and currencies. Some of the key benefits of opening an account with Zerodha include:

- Low brokerage fees with a transparent pricing model.

- Access to Kite, a powerful trading platform with advanced charting tools.

- Commission-free direct mutual fund investments via Zerodha Coin.

- Educational resources through Varsity by Zerodha.

- Innovative tools like Streak (algorithmic trading) and Sensibull (options trading).

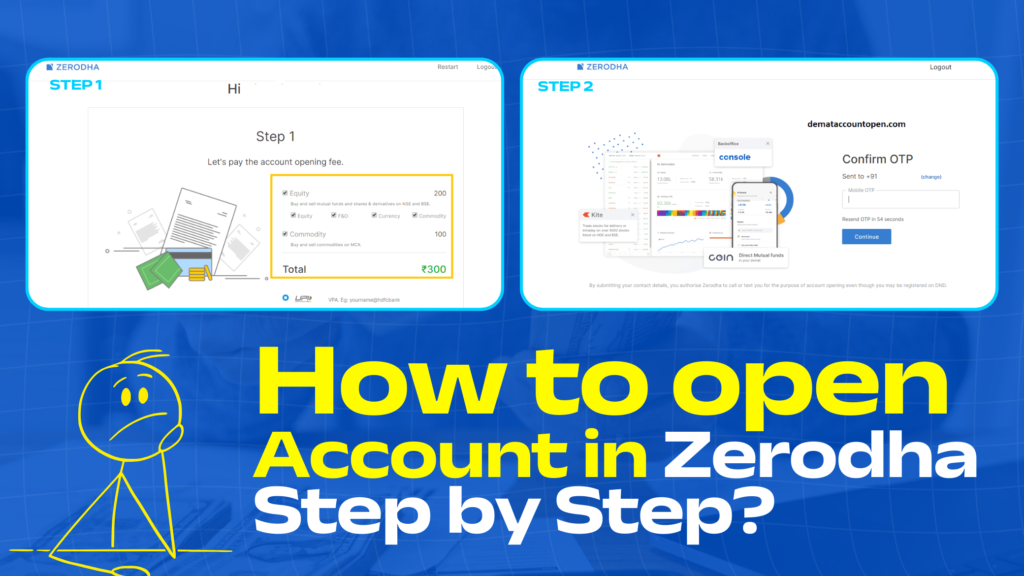

Zerodha Account Opening Charges

Opening an account with Zerodha involves certain charges, which vary based on the type of account you choose.

a) Equity and Derivatives Trading Account Charges

- Online Account Opening: Rs. 200

- Offline Account Opening (Paper-Based): Rs. 400

b) Commodity Trading Account Charges

- Online Account Opening: Rs. 100

- Offline Account Opening: Rs. 300

c) Annual Maintenance Charges (AMC) for Demat Account

- Rs. 300 per year (charged quarterly at Rs. 75 per quarter)

Documents Required for Opening an Account

To open a Zerodha account, you need the following documents:

- PAN Card (Mandatory for KYC verification)

- Aadhaar Card (For online e-KYC verification via Digilocker)

- Bank Account Proof (Cancelled cheque or bank statement)

- Signature Proof (Scanned signature on white paper)

- Income Proof (Required for F&O, commodity, and currency trading)

- Latest salary slip or IT return

- Bank statement for the last six months

Step-by-Step Process to Open a Zerodha Account

Step 1: Visit the Zerodha Website

Go to Zerodha’s official website and click on the ‘Sign Up’ button.

Step 2: Enter Your Mobile Number and Email

Provide your mobile number and email ID. You will receive an OTP for verification.

Step 3: PAN Card and Aadhaar Verification

Enter your PAN card details and verify your Aadhaar through Digilocker.

Step 4: Provide Bank Account Details

Enter your bank account details for fund transfers and withdrawals.

Step 5: Upload Necessary Documents

Upload scanned copies of your PAN card, Aadhaar, bank proof, and signature.

Step 6: Complete e-Sign Process

You will be redirected to NSDL’s e-sign portal, where you need to verify your identity using Aadhaar OTP.

Step 7: Pay the Account Opening Charges

Make the required payment for the account opening fees.

Step 8: Verification and Account Activation

Once all documents are submitted, Zerodha will verify your details. The account activation process typically takes 24-48 hours.

Offline Account Opening Process

For those who prefer not to use the online method, Zerodha also provides an offline account opening option. The process involves:

- Downloading and filling out the account opening form from Zerodha’s website.

- Attaching self-attested copies of the required documents.

- Sending the documents to Zerodha’s registered office.

- Once processed, the account will be activated within a few days.

Understanding Additional Charges

Apart from account opening fees, there are other charges traders should be aware of:

- Brokerage Charges: Rs. 20 or 0.03% per executed order (whichever is lower) for intraday and F&O trading.

- DP Charges: Rs. 13.5 per scrip per day for selling stocks from the Demat account.

- Stamp Duty and SEBI Charges: These vary based on transaction value.

- Payment Gateway Charges: Rs. 9 per transaction for UPI and Rs. 9+GST for net banking deposits.

How Long Does the Account Opening Process Take?

- Online account opening: 24-48 hours (if documents are verified successfully).

- Offline account opening: 5-7 working days (due to courier delays and manual processing).

Common Issues and How to Resolve Them

1. Aadhaar-Based eSign Not Working

- Ensure that your mobile number is linked to your Aadhaar card.

- Clear your browser cache and try again.

- Use a different browser (Google Chrome works best).

2. Payment Not Processed

- Check if the payment has been debited from your account.

- If deducted but not updated, wait for 24 hours or contact Zerodha support.

3. Account Not Activated After Submission

- Double-check your email for any pending document requests from Zerodha.

- Contact Zerodha’s support team via the ticketing system.

Who Should Open a Zerodha Account?

- Beginners: Low-cost and easy-to-use platform with educational resources.

- Active Traders: Competitive brokerage fees make it ideal for frequent traders.

- Long-Term Investors: Zero brokerage on equity delivery makes it cost-effective.

- F&O Traders: Fixed brokerage per trade helps manage costs efficiently.

Conclusion

Opening an account with Zerodha is a straightforward process, provided you have all the necessary documents. With competitive pricing, powerful trading platforms, and a seamless account-opening process. Zerodha remains a top choice for traders and investors in India. Understanding the charges and steps involved will help you set up your account efficiently and start trading with confidence.

By following the step-by-step guide mentioned above, you can ensure a hassle-free onboarding experience with Zerodha. Whether you are a beginner or an experienced trader, being aware of the account opening charges and the overall process can help you make informed decisions and start your trading journey smoothly.