Investing in the stock market has become more accessible with the rise of online trading platforms. Two of the most popular choices in India are Groww and Zerodha. Both platforms offer robust features, but they cater to different kinds of investors. If you’re a beginner looking for the best platform, this comparison will help you decide.

Ease of Account Opening

Groww:

- 100% online, paperless process.

- Quick KYC verification with Aadhaar, PAN card, and bank details.

- No account opening fees.

Zerodha:

- Online account opening available, but requires DigiLocker or manual document upload.

- Charges an account opening fee (approx. Rs.200 for equity and Rs.300 for commodity trading).

- KYC process may take longer compared to Groww.

Verdict: Groww is more beginner-friendly with a completely free and fast account opening process.

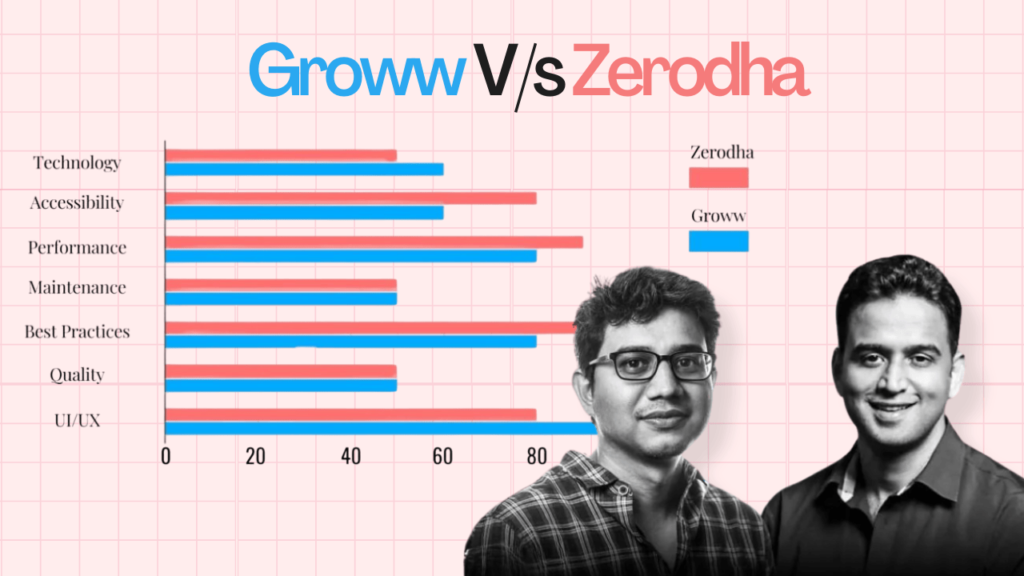

User Interface and Experience

Groww:

- Simple, intuitive, and easy to navigate.

- Mobile-first approach with a clean dashboard.

- Ideal for beginners with minimal technical jargon.

Zerodha:

- Advanced interface with multiple trading tools.

- The Kite platform offers in-depth market insights.

- Might be overwhelming for new investors.

Verdict: Groww’s user-friendly interface makes it better suited for beginners, while Zerodha’s Kite platform is more beneficial for experienced traders.

Investment Options

Groww:

- Stocks, mutual funds, gold, fixed deposits, and US stocks.

- No derivative trading.

Zerodha:

- Stocks, mutual funds, commodities, futures & options (F&O), and bonds.

- No US stocks.

Verdict: If you’re looking for derivative trading, Zerodha is the better choice. However, Groww offers a wider range of beginner-friendly investment options like US stocks and fixed deposits.

Brokerage and Charges

Groww:

- Rs.20 or 0.05% per order (whichever is lower) for stock trading.

- Zero commission on direct mutual funds.

- No account maintenance charges.

Zerodha:

- Rs.20 per trade for intraday and F&O.

- Free equity delivery trading.

- Rs.300 annual account maintenance charge (AMC).

Verdict: Zerodha is better for those who focus on delivery-based trading (since it’s free), while Groww is more cost-effective for mutual fund investors.

Research and Learning Tools

Groww:

- Basic stock analysis and insights.

- Blogs, educational videos, and webinars for beginners.

Zerodha:

- Advanced charting tools and research reports.

- Varsity by Zerodha, is a free educational platform with extensive courses.

Verdict: Zerodha is superior in terms of market research and educational resources, while Groww provides simpler investment insights for beginners.

Customer Support

Groww:

- Email and chat support are available.

- No dedicated phone support.

Zerodha:

- Phone, email, and ticket-based support.

- Detailed help center with FAQs and community discussions.

Verdict: Zerodha offers more comprehensive customer support, including phone assistance, whereas Groww primarily relies on chat and email support.

Security and Regulations

Groww:

- SEBI registered and AMFI certified.

- 128-bit SSL encryption for secure transactions.

Zerodha:

- SEBI registered and NSDL/CDSL regulated.

- Two-factor authentication for additional security.

Verdict: Both platforms are highly secure and regulated, ensuring safe transactions for investors.

Mobile App Performance

Groww:

- Lightweight app with smooth navigation.

- Offers a simplified interface for quick investments.

- Regular updates with new features.

Zerodha:

- Kite app provides advanced trading features.

- Can be slightly complex for first-time users.

- More suited for professional traders.

Verdict: Groww’s app is more beginner-friendly, while Zerodha’s Kite app is better for advanced traders who need more tools.

Pros and Cons of Each Platform

Groww:

Pros:

- Easy account opening with no charges.

- Simple user interface ideal for beginners.

- No annual maintenance charges.

- Supports investment in US stocks.

Cons:

- Lacks derivative trading (F&O).

- Limited customer support options.

- Basic research tools compared to Zerodha.

Zerodha:

Pros:

- Free delivery-based trading.

- Advanced tools for research and technical analysis.

- Varsity educational platform for in-depth learning.

- Reliable customer support, including phone assistance.

Cons:

- Rs.300 annual maintenance fee.

- Slightly complex interface for beginners.

- No US stock investment option.

Which is Better for Beginners?

- Choose Groww if you are a beginner looking for a simple, easy-to-use platform with minimal charges and an excellent mutual fund investment experience.

- Choose Zerodha if you are interested in advanced trading tools, free delivery trading, and learning in-depth investment strategies.

Both platforms have their strengths, but for absolute beginners, Groww is the better choice due to its simplicity, ease of use, and quick onboarding process. However, as you gain experience and want to explore advanced trading strategies, Zerodha becomes a strong option with its superior tools and educational resources.