Investing in mutual funds through a Systematic Investment Plan (SIP) is one of the best ways to grow wealth over time. SIPs offer a disciplined approach to investing by allowing you to invest small amounts at regular intervals, helping you build wealth without the burden of timing the market. If you’re considering starting an SIP on Angel One, this guide will provide you with all the essential details, benefits, and step-by-step instructions to get started.

What is a SIP?

A Systematic Investment Plan (SIP) is a method of investing in mutual funds where a fixed sum is invested at regular intervals (monthly, quarterly, etc.). This allows investors to benefit from rupee cost averaging and compounding, making it an ideal choice for long-term wealth creation.

Benefits of SIPs:

- Disciplined Investing: Encourages regular savings and investment habits.

- Power of Compounding: Small investments grow exponentially over time.

- Rupee Cost Averaging: Reduces risk by averaging out the purchase cost.

- Flexible & Affordable: Start with as low as Rs.500 per month.

- No Need to Time the Market: Invest automatically without worrying about market volatility.

Why Choose Angel One for SIP Investment?

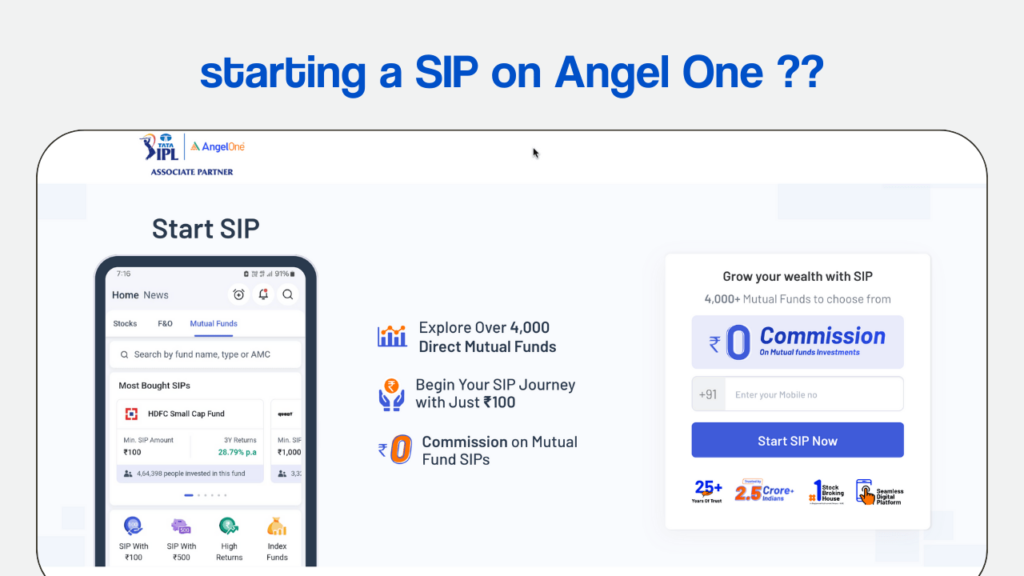

Angel One is one of India’s leading brokerage firms, offering a seamless platform for mutual fund investments. Here’s why you should consider starting your SIP with Angel One:

a. Zero Commission Investments

Angel One offers direct mutual funds, meaning you pay zero commission, ensuring higher returns.

b. Easy & Paperless Process

With a completely digital on boarding process, you can start your SIP investment in just a few minutes.

c. Wide Range of Mutual Funds

Angel One provides access to a diverse range of mutual fund schemes from top asset management companies (AMCs).

d. User-Friendly Interface

Both the web platform and mobile app offer an intuitive experience, making it easy to track and manage investments.

e. Automated SIP Management

Set up auto-debits for hassle-free investments, ensuring you never miss an installment.

How to Start a SIP on Angel One?

Starting a SIP investment on Angel One is simple and can be done in a few easy steps:

1: Open a Demat & Trading Account

- Visit the Angel One website or download the Angel One app.

- Register using your mobile number and email ID.

- Complete KYC verification by submitting your PAN, Aadhaar, and bank details.

2: Explore Mutual Fund Options

- Log in to your Angel One account.

- Go to the Mutual Funds section.

- Use the filters to select funds based on returns, risk profile, and investment goals.

3: Select a Mutual Fund for SIP

- Compare funds based on past performance, expense ratio, and risk factor.

- Choose the mutual fund that aligns with your financial objectives.

4: Set Up SIP Details

- Select investment amount (Minimum Rs.500 per month for most funds).

- Choose SIP frequency (Monthly, Quarterly, etc.).

- Pick the start date and investment duration.

5: Complete Payment Setup

- Link your bank account for automatic SIP payments.

- Enable auto-debit via UPI or Net Banking.

- Confirm your investment and approve the e-mandate.

6: Track and Manage Your SIP

- Monitor SIP performance through the Angel One dashboard.

- Modify SIP amount, pause, or stop investments anytime.

Top Mutual Funds Available on Angel One for SIP

If you’re unsure about which mutual funds to choose, here are some popular SIP investment options:

a. Large-Cap Mutual Funds (For stable long-term growth)

- SBI Bluechip Fund

- HDFC Top 100 Fund

- ICICI Prudential Bluechip Fund

b. Mid-Cap Mutual Funds (For high growth potential)

- Axis Midcap Fund

- Kotak Emerging Equity Fund

- DSP Midcap Fund

c. Small-Cap Mutual Funds (For aggressive investors)

- Nippon India Small Cap Fund

- SBI Small Cap Fund

- Axis Small Cap Fund

d. Hybrid Mutual Funds (For balanced risk-return profile)

- HDFC Balanced Advantage Fund

- ICICI Prudential Equity & Debt Fund

- SBI Equity Hybrid Fund

Tax Benefits of SIP Investment

SIP investments in Equity Linked Savings Scheme (ELSS) funds offer tax benefits under Section 80C of the Income Tax Act. By investing in ELSS funds, you can claim deductions up to Rs.1.5 lakh per financial year.

Common Myths About SIPs

1. SIPs Guarantee Returns

- Reality: SIPs invest in market-linked mutual funds, and returns vary based on market performance.

2. SIPs Are Only for Small Investors

- Reality: SIPs can be customized for both small and large investors based on financial goals.

3. Stopping a SIP Will Result in Losses

- Reality: You can stop, pause, or redeem SIP investments anytime without incurring losses, as long as your investment is profitable.

How to Maximize Returns from SIP Investments?

a. Start Early

- The earlier you start investing in SIPs, the more you benefit from compounding.

b. Stay Invested for the Long Term

- SIPs perform best over 5-10 years, as they average out market fluctuations.

c. Increase SIP Amount Regularly

- Consider SIP top-ups to increase your investment amount in line with income growth.

d. Diversify Your Portfolio

- Invest in a mix of large-cap, mid-cap, small-cap, and hybrid funds for better risk-adjusted returns.

Final Thought

Starting a SIP on Angel One is one of the easiest and most efficient ways to grow your wealth. With its zero-commission model, automated SIP management, and an extensive range of mutual funds, Angel One provides an ideal platform for investors of all experience levels.

By investing in a disciplined manner and choosing the right funds, you can achieve financial stability and long-term wealth creation with SIPs.